Our Core Services

We offer holistic and value-driven innovative solutions to scale your businesses to the next level.

About our blockchain development services

One of India's top blockchain development firms, Prolitus, has a wealth of experience in offering blockchain solutions. With blockchain technology, which promises to become the technology of this decade, your company can carry out regular business transactions reducing the use of any middlemen to almost nil. With our first-rate services, we assist new and established businesses in creating an effective, transparent, and automated digital platform. In addition, we offer various blockchain development services, such as developing NFT marketplaces, web 3.0 applications, dApps, smart contracts, DeFi wallets, cryptocurrency exchanges, etc.

In order for its clients to achieve their company objectives and grow their enterprise, Prolitus's mission is to provide exceptional solutions using blockchain technology. Prolitus teams, with years of experience and competence in developing blockchain applications provide services and solutions across multiple business domains like BFSI, Healthcare, Manufacturing, Logistics, Supply chain etc.

Protocols We Work With

Ethereum

Ethereum is a decentralized, open-source blockchain that possesses smart contract functionality.

Stellar

Stellar is a decentralized protocol for building financial products and seamless cross-border transactions.

Polygon CDK

Polygon CDK is an open source framework for launching ZK-powered L2 chains for Ethereum, on demand.

Substrate

Substrate is a blockchain development framework that allows the building of cross-chain bridges, parachains, and DApps.

Polkadot

Polkadot is an open-source Web3 blockchain network for enabling interoperability and interconnectivity.

Near Protocol

NEAR Protocol is an Ethereum competitor and DApps platform that is developer friendly.

Solana

Solana is a groundbreaking blockchain network that aims to provide fast, secure, and scalable decentralized solutions.

CASE STUDIES: Our Blockchain Development Work

Virtuse Group is one of the largest carbon emissions, power and gas trader in Europe and China. Their team consists of knowledgeable professionals from leading financial institutions in Europe, to experienced blockchain experts and developers in Asia. Virtuse has a balanced team with a wide field of experience in cryptocurrencies, investment banking, commodities trading, start-ups, and consulting. With trading in different areas, the company wanted to start the trading of cryptocurrencies and other digital assets and wanted to connect crypto assets with commodities, bridging the old financial market with the new.

Building LedgerScore aimed to offer crypto users to keep track of their crypto income, crypto assets, and crypto payments and not be part of the isolated, anonymous crypto world where it's difficult to track credit scores based on the activities. The lenders can further verify this information so that users can easily apply for loans against their crypto earnings along with the collateral.

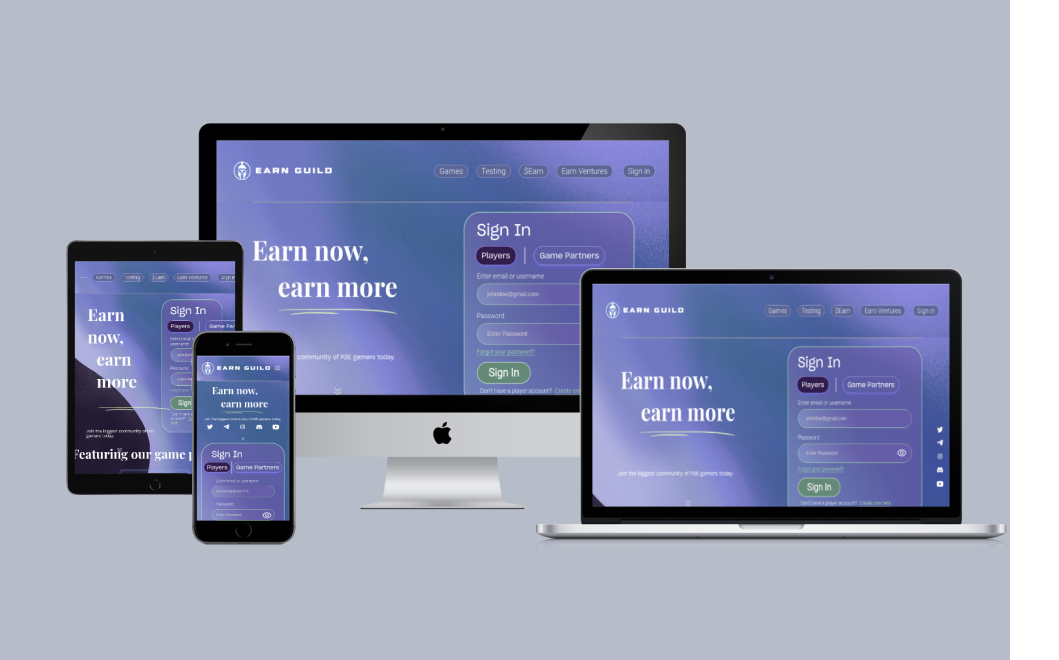

Earn Guild platform is a one-stop solution for gamers to earn some passive income by playing the listed games on the platform. Furthermore, users can further trade their in-game rewards with different tokens through the in-game exchange platform or withdraw them as fiat currency.

VERTICALS

WE

SERVE

BFSI

Manufacturing

Logistics & Supply Chain

Media & Entertainment

Travel & Hospitality

Healthcare & Life Sciences

Retail & Consumer Goods

Energy & Utilities

Government & Public Sector

OUR CLIENTS

OUR PARTNERS

WHAT OUR CLIENT HAS TO SAY ABOUT US

Trusted Worldwide

FAQ

Frequently Asked Questions

contact

us

Have a Project in mind?

Let’s make it happen